Google and the Innovators Dilemma

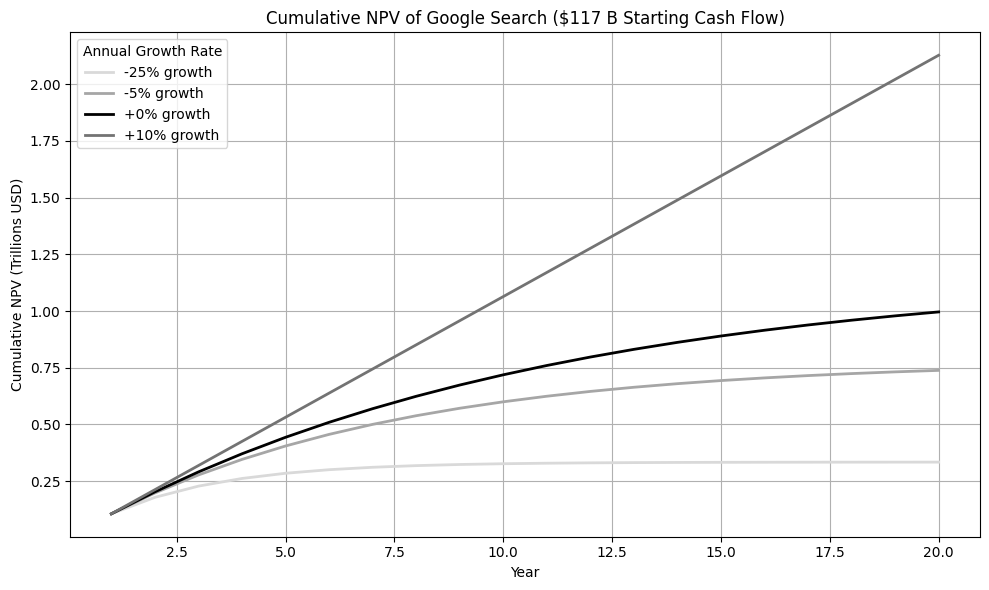

Google Search is worth roughly one trillion dollars in NPV; and one UI change could take a big chunk out of it. Google is facing a true Innovators Dilemma - with attacks from internal products and external competition and the dilemma does not easily resolve to pushing aside Search and converting google.com into a chat interface as some have argued.

If you find this or any other numbers to be inadequate you can run the calculations with your own numbers using the Jupyter notebook provided at the end of the article.

Let’s start with the top line. Google Search brought in revenues of $195B in 2024. Because I do not have internal numbers from either OpenAI or Google, I will need to make some assumptions for the purpose of this argument. The first assumption will be that Google Search’s margin is 60%. This sets a FCF at an estimated $117B.

We are also going to be using a discount rate of 10%, which seems fair for a large-cap tech business facing regulatory and competitive pressure. We are also going to cap our NPV after 20 years due to uncertainty, but you are free to play around with the Jupyter notebook to validate the numbers to your own standards.

We will be performing our analysis using net present value (NPV) under a series of cases regarding Google Search’s business. As a reminder, here is the NPV equation.

Where:

- = Cash flow at time

- = Discount rate

- = Year (from 1 to n)

- = Total number of periods

No Growth

First and most simply let us look at the NPV of Google Search should it provide flat income. This simplifies the equation as we have a constant .

Where:

- = Cash flow in 2024 = $117B / yr free cash flow

- = Discount rate = 10%

- = Total number of periods = 20

Plugging these in we get NPV of $996B. So as it stands Google Search is worth roughly one trillion dollars.

Maintain Growth

Let’s look at the NPV where Google Search maintains its current growth of around 10% annually. For this we will need to return to the generalized NPV formula. As a reminder:

As we are considering a uniform growth rate we can set:

Where:

- = Cash flow at time ,

- = Year (from 1 to n),

- = Discount rate = 10%,

- = Total number of periods = 20,

- = Cash flow in 2024 = $117B / yr free cash flow, and

- = Growth rate (shrinkage if negative) = 0.10.

Plugging these values in we get an NPV of $2127B. So if Google Search were to maintain a flat growth rate in line with its current growth it is now worth more than two trillion dollars. Based on current market capitalization and the value in other parts of Google’s business I think it is clear that this number is optimistic relative to the scale and competitive headwinds facing Google.

Lose Share to AI Competitors

Now let’s take a case where Google Search loses 5% per year in income due to the growth of competitive LLMs. This is as above with:

- = -0.05

and results in an NPV of $738B. This is a significant relative loss, but not nearly as much as Google would lose should they push chat over Search.

Push Innovation

Now let’s consider the situation where Google actively pushes its users from Search to chat. In this case I will assume that Google Search loses 25% per year in income. This would be a simplified assumption as in practice the decay to Google Search would likely follow an S-shaped adoption curve, however, I think this is a reasonable worst case scenario.

With:

- = -0.25

we get an NPV of $334B.

Comparing a reasonable status quo scenario (no further search growth or shrinkage) with the push innovation scenario we get:

Or a NPV change of $662B should they choose to move aggressively to canabalise themselves.

Positive EV

I am going to refrain from commenting on the viability of chat to supplant this $662B of NPV and comment only that when discussing the Innovators Dilemma, I believe that what Google should be considering regarding what to place on google.com is not whether Google Search will lose market share, or whether Google Gemini can become the leading llm chat interface, but instead - will putting chat on the home page result in an expected value increase greater than the expected value of lost future earnings from Google Search. Or based on my numbers, will placing chat on Google the home page result in the generation of cash flows worth more than $662B in NPV from chat.

False Dilemmas

“What are your choices when someone puts a gun to your head? You take the gun, or you pull out a bigger one. Or, you call their bluff. Or, you do any one of a hundred and forty six other things.” - Harvey Spector, Suits

Where I believe the proponents of chat taking over google.com are correct is that doing so would immediately give Google a chat volume advantage relative to any of their competitors. We see with post training that databases of high quality chat can improve LLM results.

So if chat volume is a constraint on the developing of Google’s future LLM versions and if this will lead to the 100x output which may be viable should LLM’s reach the heights which some people expect, then it makes sense for Google to put chat on the front page.

Another concept which Google has already implemented it embedding AI overviews inside conventional ad-containing results, this preserves the revenue stream while presumably still creating data to improve their LLM offerings.

In the case that chat volume is not integral to the development of the future of LLM and AGI, then google should look at all other alternatives prior to changing the default google.com page.

Heathrow’s Outage Coverage: Missing Context

Stephen CastleMichael D. Shear and Peter Eavis writing for the New York Times:

“Unfortunately, there is no resilience built into the National Grid,” Mr. Kuball, a Royal Academy of Engineering chair in emerging technologies, wrote at the Science Media Center. “In part, this is because we still rely on old technology in substations that use copper windings to distribute power rather than new technology, so-called solid state transformers.”

There is no context provided for this quote in the original article, so I will provide some here.

Resilience is an interesting word for Mr. Kuball to choose. The UK’s National Grid is widely considered to be one of the more resilient electrical systems in the world. It has redundancies, protections, and a generally high level of reliability. I will give Mr. Kuball the benefit of the doubt and assume he did not mean to say that the National Grid has no resilience as surely that would effectively mean the grid is non-functional. Grids are constantly adapting and functioning despite operational errors, equipment failures, and natural disasters. What doesn’t have built-in resilience, apparently, is Heathrow’s internal power architecture. Blaming the entire national grid for what appears to be a single point of failure at one site is a misdirection. The article repeats this quote without question, which misses the more interesting and relevant problem: Heathrow couldn’t rapidly switch over to its other power sources. There is not a law of physics which requires hour long outages to switch over power sources. The hours long outage at Heathrow is likely a result of cost and design tradeoffs which, in hindsight, may have been made differently. In this context, resilient doesn’t mean outages never happen — it means systems are designed to limit the impact and recover quickly when they do.

It is also weird to drop in a reference to copper winding as old technology. While copper winding transformers were invented nearly 200 years ago they are still by far the most commonly put into service in most applications today. Solid-state transformers are an emerging technology. They’re promising, yes, but not a drop-in replacement for traditional grid equipment — not yet, and certainly not at the scale of a major airport. Suggesting that their absence is the root cause of the Heathrow failure is a distraction. Infrastructure resilience has more to do with system design, failover logic, and coordination than simply deploying the newest tech. Infrastructure as critical as Heathrow should be designed with redundancy in mind, such that it could withstand the failure of any single transformer.

If you are aware of any utilities using Solid-state transformers as direct replacement for oil-filled traditional transformers please let me know.